Month: December 2016

12 Mistakes We Make at Christmas

One of the favorite Nelson children Christmas traditions is to lay the bed mattresses on the basement family room floor and have a sleepover on Christmas Eve. They lay side-by-side, eat who-knows-what-kinds of sugary junk and watch Christmas movies until sugar plums dance in their heads. Their favorite movies are “Elf,” “Home Alone,” and “Christmas With the Kranks.”

If you haven’t seen “Christmas With the Kranks,” it’s one of Jamie Lee Curtis and Tim Allen’s more endearing movies. It’s about family, and what extreme, half-brained ordeals we’ll endure for our kids, especially around the holidays. Go watch it if you haven’t yet.

This year, we are known as the “Kranks,” not the Nelsons. We were inspired by this movie, based on John Grisham’s book, “Skipping Christmas” and decided to not celebrate Christmas in the traditional way for the first time ever. The week before Christmas Day, our family will be going to California. While my husband and I, along with the other Nelson siblings and spouses, celebrate with my in-laws on their 60th wedding anniversary on a Baja Cruise, our kids will spend the week at amusement parks. It’s our Christmas present to them.

In anticipation of being gone, I did the unthinkable. The most anti-holiday thing ever. Call my Grinch (or Mrs. Krank), but I didn’t put up a tree, a decoration, or lights. Not having to buy and wrap a single present, decorate with a single ornament, or hang a single stocking gives me a tingle of relief for the first Christmas ever. I want to break out in a Holly Jolly cheer.

I’ve driven around town filled with peppermint glee as I pass by cars filling the mall parking lot and lines of people at the stores. I don’t have to join the throngs and fight the crowds. Suckers! It’s been the most stress-free holiday ever. Shopping is a major cause of stress followed by the post-holidays blues of overspending. I’d like to share some of the major mistakes parents make over the holidays. It’s easier to see from my perch on Mount Crumpit.

- Shopping without a budget. Before you make any purchases, figure out how much you can afford to spend, stick to your budget and track your spending. Don’t make purchases you haven’t budgeted for.

- Not sharing the cost of entertaining. While it is tempting to just cover all of the costs yourself, share your entertaining costs by assigning such things as food and game supplies with guests.

- Shopping at the last minute. Buying “little” gifts for too many people. In fact, consider an alternative to gift exchanges, neighbor gifts, and expensive stocking stuffers. Stocking stuffers used to be things like candy, nuts and oranges (or in our case, flavored dental floss and nail clippers, yes we are THAT practical). Now they have to be season tickets to Lagoon and expensive non-essential toys. Rather than friend gifts, perhaps ask if they’d like to donate money or service to charity and share with them what you did. Buying last minute is a problem because everything is picked over, the crowds will suck the cheer out of the merriest of persons, and you end up buying more than you planned on.

- Buying new decorations and clothes every year. Besides, that ugly Christmas sweater just keeps on getting better with every new year. Use a black dress and accessorize with something less expensive to buy, or get one new tie to go with a suit or sweater.

- Not taking advantage of free activities. We overspend going to way too many holiday activities that have a large fee, and when we take kids, the costs increase.

- Not shopping a year in advance, which is where you get the best deals. If you haven’t already, learn how to shop after-holiday sales instead of before-holiday rip offs.

- Buying overpriced wrapping paper and greeting cards just to make your gifts look extra special. The kids are going to rip them open anyway to get to the present inside and throw away the paper. They get the gift nonetheless but your wrapping may add dollars to the total price of that gift. Instead of fancy store-bought cards, consider going to e-cards or buy on clearance. I bought mine for 50 cents a box at the ReStore last year. Score!

- Splurging on meals away from home. You don’t need to eat out to celebrate the Christ child’s birth. Also, see #2.

- Paying for warranties on appliances and electronics. Odds are that you won’t need the extra coverage because most major appliances don’t break down during the extended-warranty period. Or you might already be covered. The four major credit card networks — Visa, MasterCard, Discover and American Express — provide up to a year of extended warranty protection for some cardholders, according to credit card comparison site cardhub.com.

- Not clearly planning your charitable contributions. We all want to help out those in need during the holidays, but we usually either go overboard, don’t plan a set amount or get carried away with everyone who approaches your help. This can add up quickly

- Going overboard for your kids. It is an easy thing to do, out of desire to make the season magical and a desire to grant their every wish, but be careful. Stay the course on your predetermined amount of money available for gifts, and live within the reality of your budget. Tell them the budget you have and the price point. We do that with the car salesman, why not with kids?

- Buying for yourself. I had a friend post on facebook last week, “How many times have I started a sentence with: As an early Christmas present to myself…”? Unless that early Christmas present to yourself means taking a nap, reading a good book, or playing a board game with your kids, you should be wise how you justify buying things. While you may be worth it, no matter how good the deal, pass it up. On average we spend about $130 on ourselves during the holidays, according to the National Retail Federation. So be careful…that is a lot of money.

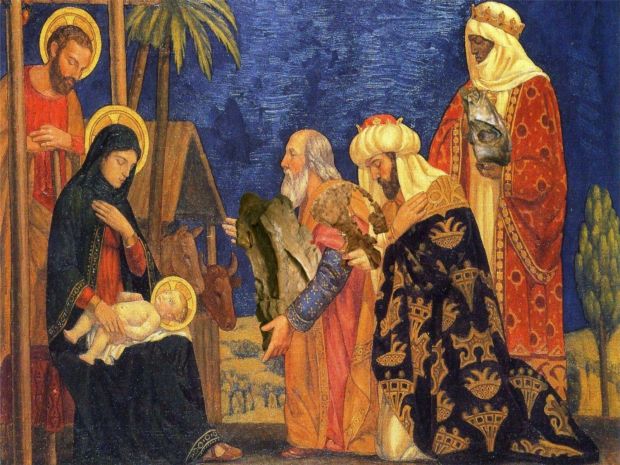

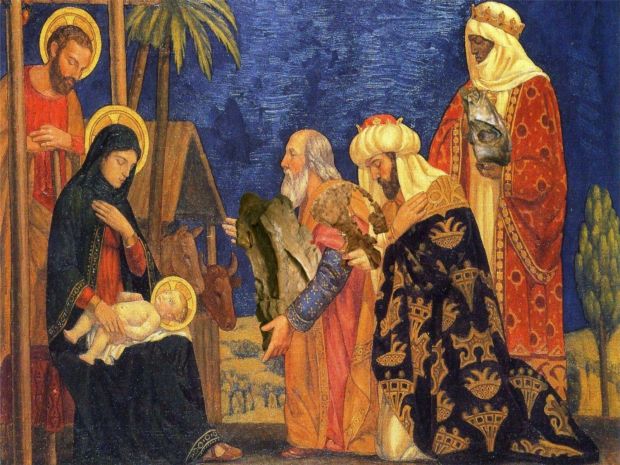

Remember that “Christ” should be at the center of “Christmas” and that the spirit of the season can’t be bought from a store. Dr. Seuss got it right after all.

These ideas are taken from an article written by Teresa Hunsaker in Live Well Utah.